An emergency savings fund is meant to help you deal with unexpected expenses. If you need a major car repair or you experience a medical emergency, you can use your emergency savings fund to cover the bill instead of taking out a loan, charging the expense to your credit card or, worse yet, tapping into retirement savings. If you lose your job, your emergency savings can help you stay afloat while you look for work.

Just like with retirement savings, advice on how much to save for emergencies varies a lot. Common recommendations range from saving three months’ worth of your basic necessities up to six months’ worth of your total living expenses. For most people, there’s a huge difference between those two amounts.

So how much should you save? The right amount depends on a few factors, including your job stability and assets. If any of the following scenarios applies, you’ll want to aim closer to saving six months’ worth of living expenses for emergencies:

- You have one or more people who are financially dependent on your income.

- You earn income seasonally, or you’re in an industry where work would be hard to find if you lost your job.

- You regularly need medical services or medications that aren’t covered by your insurance.

- You own something that periodically needs repairs, like a home or vehicle.

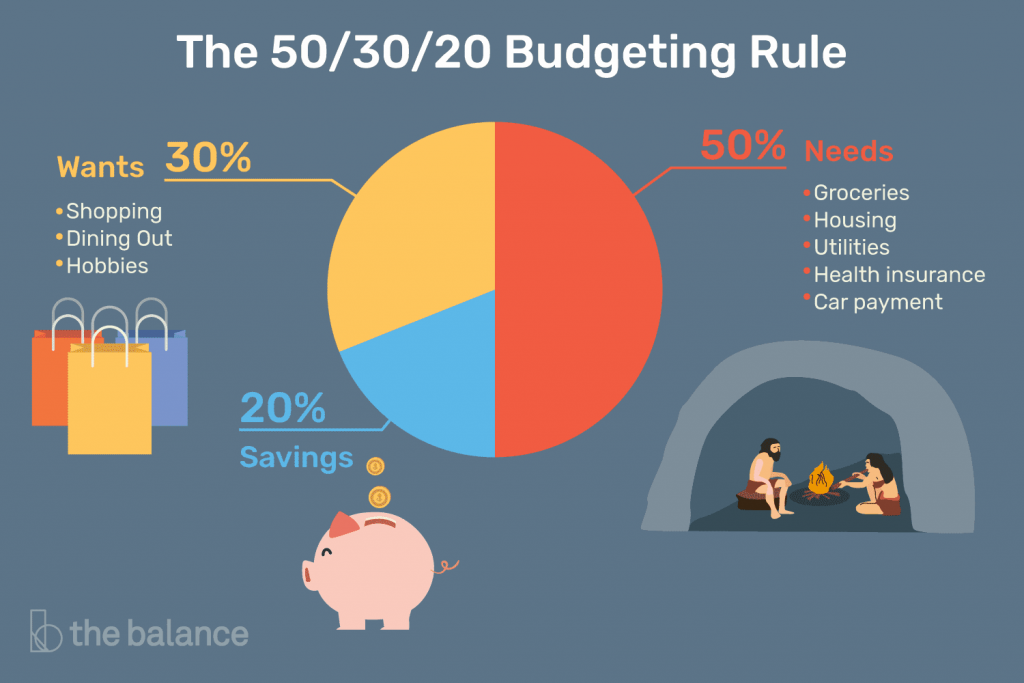

Consider a 50/30/20 Budget

A great way to work towards your savings targets is to set aside a percentage of your earnings every month toward those specific goals. The 50/30/20 rule offers a basic guideline for how much of your income to save. Here’s a breakdown of how to apply the rule:

- 50%: Necessities. Use half of your total take-home pay to cover your necessities. This category includes your rent or mortgage, utilities, groceries, prescriptions, minimum debt payments and the cost of transportation. If your necessities exceed 50% of your income, consider looking for ways to cut back on spending or increase your income (a second job or side gig, perhaps).

- 30%: Discretionary spending. This category covers purchases for things you enjoy but don’t necessarily need. Discretionary spending can include a combination of travel, dining out, gifts, recreation, clothing and entertainment.

- 20%: Debt payments and savings. The remainder of your take-home pay should be split between extra payments towards your debt and regular contributions to your savings. You can further split savings amongst your emergency fund, retirement accounts and special funds for upcoming goals like a down payment on a car or a house.

The 50/30/20 rule isn’t hard and fast. If your rent takes up nearly 50% of your take-home pay, you’ll need to alter these percentages. Even if you’re unable to save 20% of your income, you can choose a smaller amount and commit to saving that percentage consistently—you can always adjust later.